Buying silver is better than holding cash over the long-term. But I’m talking decades. Contrary to popular belief, precious metals are a terrible inflation hedge (I’ll show you better investments below). And this is just one of six reasons why silver is a bad investment…

Why Silver is a Bad Investment

- Silver isn’t a good inflation hedge

- It doesn’t produce income and has low utility

- Costs to mine, refine, trade, and keep safe

- Silver is no longer a useful currency

- It’s a bad doomsday asset (better plan below)

- Not useful for diversification

When I was young, I bought silver and gold. But now in my wiser years, I’ve been winding down my precious metal holdings. I sold a gold Buffalo in 2020 for around $2,000…

Trying to time the market is a fool’s game and I got lucky. Since then, gold has traded lower most of the time. It took a few years to hit new highs and silver followed a similar trend.

With higher silver prices, I made another move a few weeks ago. I sold a 100-ounce silver bar for $2,525. But why am I selling my silver? The following logic should give you a clear picture. This research can help you become a better investor…

Silver vs. Inflation Shows It’s a Bad Hedge

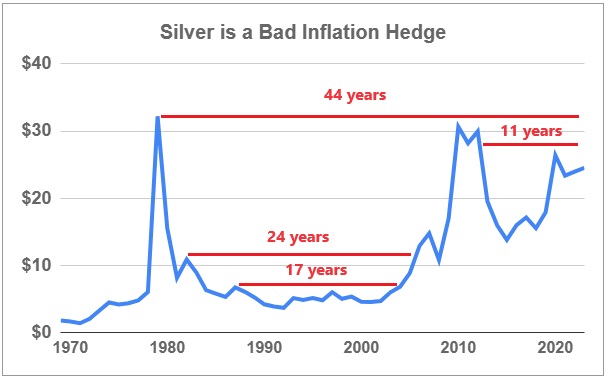

Silver is too volatile to be a useful inflation hedge. Here’s why…

If you bought silver in 1980, you still might be showing a negative return today. And that’s before adjusting for inflation. Your real returns would be much lower.

This example shows one of the worst times you could have bought silver. But as you can see in the chart, there are many bad times you might buy. You could easily end up waiting 10 years just to break even.

Silver is a bad investment to counter inflation. And this chart only shows year-end prices. There’s more volatility in any given year.

If you have a crystal ball and want to try buying the lows (and selling the highs), more power to you. But Warren Buffett can’t do it, and neither can I. And of course, anyone can get lucky a few times, but consistency is the tough part.

Better Inflation Hedge: If you know you’ll need the cash in the short-run, CDs and investment grade bonds can be better than silver and gold. The fixed income is more reliable for meeting your upcoming expenses. And for an even better inflation hedge, look into buying I-Bonds and TIPS directly from the government.

Silver Won’t Save You in Doomsday Scenarios

The probability of seeing a doomsday collapse in our lifetimes – and silver turning into a top means of trade – is close to zero. But let’s entertain the idea…

All hell breaks loose. A catastrophe destroys the money system. Good thing you’ve got that vault filled with silver and gold.

But wait, no one wants your silver and gold!

Food, ammunition, and medicine are the real currency. Instead of stashing $100,000 worth of gold and silver coins, you could have built a fully stocked safe house (tiny home). Not only that, but you could have rented it out on Airbnb to make some extra cash.

Then during a complete collapse, you can trade a few of your extra supplies for more gold and silver coins than you could have started with.

Silver is a Bad Investment Except…

If you plan to hold lots of cash for decades, silver is a better way to go. But outside of an emergency fund (cash and short-term secured deposits), putting your savings elsewhere is a better move.

After the Great Depression, hoarding cash was a common approach. Trust in banks was at all-time lows (rightfully so). But since, with have much better banking stability (FDIC Insurance, etc.). On top of that new technologies and the internet have increased our access and lowered costs.

If you know you’ll need the cash for upcoming expenses, check out the other investments I mentioned above.

If you’re trying to time the market, silver might swing in your favor. You can see some great returns in the short run, but it’s similar to gambling. Silver is a bad investment when compared to many other assets.

Silver can provide you with peace of mind. With a clear view of why silver is a bad investment, holding it still might make sense for you. It’s a tangible asset that can provide psychological benefits. Contrary to traditional economic beliefs, we’re not homo economicus. We’re homo sapiens with many limits on decision-making.

Selling Silver and Buying Stocks

Similar to silver, stocks are volatile. They’re both bad places to invest your cash if you know you’ll need it in a few years. And looking at the long term, stocks far outperform precious metals. Silver on average will give you a 3-4% return and that’s compared to 8-10% with stocks.

That’s why my goal is to reach at least 95% of my life’s savings in stocks. Many of them will be dividend stocks to provide steady income. And on top of that, I’m keeping a good emergency fund so I won’t be forced to sell stocks during a downturn.

Compared to stocks, silver is a bad investment. Demand for silver might continue to climb… but trying to sell at the top – consistently at least – is a fool’s game.

Letting your winners ride can be a good rule of thumb… but in this case, I see too steep of an opportunity cost. If you want to see where I’m investing my savings, check out my other articles. And feel free to reach out with any questions.