Selling covered calls is a strategy for extra income. If you have 100 shares of a company, you can sell a covered call. I’ll show you with real examples below.

I started trading options close to 10 years ago. However, I stopped buying and now only sell options. Similar to insurance, the sellers make money on average, not the buyers. The buyers pay a premium to have the option to trade the shares.

Selling Covered Calls Example

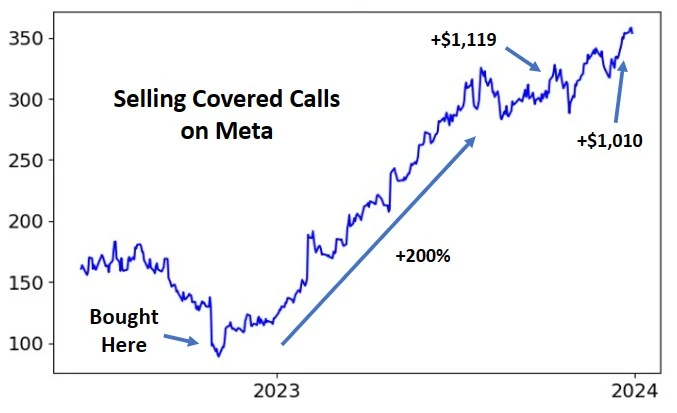

I bought 100 shares of Meta in October 2022 at $100.04. The total for those 100 shares cost me $10,004. And I didn’t plan to sell covered calls but that changed with the price…

As Meta’s share price climbed, the price to value looked less enticing. And I was more willing to sell the shares. But instead of selling them directly, I decided to sell a covered call.

On Oct 6, 2023, the share price of Meta had climbed to $315. So, I decided to sell one covered call with a strike price of $345 and expiration on Dec 15, 2023. That one option landed me an extra $1,119.

Jumping forward to expiration day, the option expired worthless. Although it was close. The closing price on Dec 15 was $334.92. Then in the next trading day (Monday Dec 18), shares of Meta climbed to $344.62.

After the 15th, I was no longer under contract to sell my 100 shares of Meta. This freed me up to sell another covered call. So, on Dec 18, I sold a covered call with a strike price of $385 that expires on Mar 15, 2024. This second option landed me an extra $1,010.

Similar to the first covered call, there are two potential outcomes…

Covered Call Example Outcomes

If on the expiration date the shares are above $385, the buyer of the call option will buy my 100 shares. They’ll pay me $38,500 and I’ll lock in a 306% return ((38,500 + 1,119 + 1,010) / 10,004 – 1).

Not too shabby for what would be less than a year and a half. I’d then use that money to invest in other stocks trading at better valuations.

On the other hand, shares of Meta might close below $385 on the expiration date. If that’s the case, I’ll keep my 100 shares and will no longer be under contract to sell my shares. Then depending on the share price, I might sell another covered call.

Overall, I still like my Meta investment. In the years ahead, I wouldn’t be surprised to see it climb much higher. My covered call position is a hedge on a larger Meta investment across my accounts. And this real covered call example is in a Roth account, so I won’t have to worry about paying taxes on the gains.

These small trades compound and taxes do as well. Here’s why I converted $93,000 to a Roth account last year. If you have any questions, feel free to reach out anytime.