This dividend yield calculator can help you compare investments. When buying a dividend stock, how much income will it generate? How do you calculate dividend yield? There’s an easy formula behind it, and this is just a starting point for investors…

Dividend Yield Calculator

If you expect the company to grow its dividend at a steady rate, check out the Gordon Growth Model Calculator. It’s one of many valuation tools to help you find how much a stock should be worth.

How to Calculate Dividend Yield

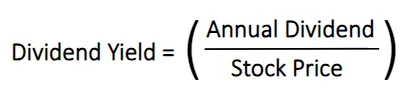

The dividend yield formula is a simple ratio…

Dividend Yield Formula

To calculate the dividend yield, divide the total dividends in a year by the current share price. This gives you the annual dividend yield.

A stock price and its dividend yield tend to move inversely. For example, if the share price climbs, the dividend yield drops. Although, companies can change how much they pay each year.

Here are two common ways to calculate annual dividends…

- Trailing Twelve Months (TTM) Dividend Yield

- Forward (FWD) Dividend Yield

The TTM dividend yield uses the total dividends the company paid in the past twelve months. On the other hand, the FWD dividend yield takes the expected total dividends for the next twelve months. Let’s look at an example…

Dividend Yield Example: TTM vs. FWD

Let’s use an example dividend stock that pays quarterly. Here’s the payout history per share…

| Q1 | Q2 | Q3 | Q4 | |

| Last Year | $0.50 | $0.50 | $0.50 | $0.50 |

| Current Year | $0.55 (announced) | $0.55 (expected) | $0.55 (expected) | $0.55 (expected) |

The TTM dividend is $2.00 ($0.50 x 4) and we’re expecting $2.20 ($0.55 x 4) for the FWD dividend. We can then use these numbers to calculate the dividend yield.

If the current stock price is $50, the TTM dividend yield is 4.0% ($2 / $50). And that compares to a FWD dividend yield of 4.4% ($2.2 / $50). If the company has a history of raising its dividends each year, using the FWD yield is more useful. This can help you compare it to other income investments.

However, dividends can change at any time…

Why Do Companies Pay Dividends?

Companies can change their dividend policies at any time. Unlike many bonds, there’s no legal obligation to keep paying dividends. A company’s board of directors usually decides how much to pay in dividends.

Companies that pay dividends tend to be more mature businesses. If they can’t reasonably reinvest their income, it’s better to give it back to investors. Investors can then decide where to reinvest or spend it.

There are also different types of dividends. The most common are the ones we’ve already reviewed. They’re cash dividends. However, sometimes companies will issue stock dividends or even less common, property dividends.

Types of Dividends

- Cash Dividends

- Stock Dividends

- Property Dividends

On top of that, some companies pay special one-time dividends. But this makes it hard to predict the dividend yield. In these cases, the dividend yield calculator isn’t too useful.

When investing for income, I generally avoid companies with inconsistent payouts. Instead, I like to see a long-track record of bigger dividends each year. A good list to start with is Dividend Aristocrats. These are companies that have paid bigger dividends each year for at least the past 10 years.

On top of that, the companies need to have a strong balance sheet and operations to keep paying dividends. If the dividend yield is too high, that might be an indicator of a dividend cut.

Why Invest in Dividend Stocks?

In the short term, the stock market is a zero-sum game. For every buyer, there’s a seller. But for most investors, it’s even worse than a zero-sum game. Trading fees have come down, but there still are implicit trading costs.

However, in the long run, the stock market is no longer a zero-sum game. That’s because some companies return their profits to investors. And dividends are a popular way to reward investors.

Here are some benefits to investing in dividend stocks…

1. Passive Income

Unlike rent and many other income sources, dividends are passive income. You don’t have to find tenants, pay insurance and property taxes, pay maintenance, etc. Once you buy a dividend stock, you don’t need to do anything.

If you bought into a well-managed company, it should keep kicking out dividends. You can become a co-owner with some of the world’s best business builders, without any of the work. If you buy shares of Microsoft, you’ll see the same dividend yield that Bill Gates gets on his shares.

2. Tax Benefits

The government rewards long-term investors with a lower tax rate. If my only source of income was dividends, I could make $60k and pay zero in federal taxes (states have different rules). This is for 2024 and should only climb as the IRS adjusts the income brackets and standard deductions for inflation.

For most people paying taxes on dividends, it’s only 15% and if you make over half a million each year, the long-term capital gains rate bumps up to 20%. But that’s still much lower than the top standard income tax rate of 37%. Rent and interest income from bonds are taxed at the higher rates.

When using a dividend yield calculator and comparing investments, it’s good to consider your returns after taxes. This becomes more important as your portfolio grows.

3. Share Price Appreciation

On top of dividends, you also have exposure to share price gains. Although, this is more of a benefit for long-term investors. In any given year, we might see a bear market. It doesn’t feel good to see a drop in your portfolio, but the market will recover. It’s moved higher after multiple world wars, pandemics and other downturns. There’s always plenty of fear mongering… but next time won’t be different. We’ll overcome and continue to hit new highs.

It’s also key to have an emergency fund and other income so you won’t be forced to sell stocks in a down year. Having a basket of dividend stocks also limits risk from specific companies. If one or a few companies cut their dividends, other dividend growth should help offset those losses.

The best investors play the long game. Dividend stocks provide cashflow and long-term capital gains. The short-term volatility is high, but holding through it should provide higher returns.

Dividend and Investing Calculators

As mentioned above, this Gordon Growth Model Calculator can help you value dividend stocks. What price should you pay for any given dividend stock? Check it out and let me know if you have any questions. Are you paying too much for your dividend stocks?

I hope my dividend yield calculator helps, along with the explanation. To become an even better investor, here are two more big ideas… This CAGR Calculator can help find the average annual return on your investments. On top of that, the Rule of 72 is a good rule of thumb to keep in mind.