The Cumulative Annual Growth Rate (CAGR) helps you compare investments. With my CAGR calculator, you can find annual returns. I’ll show you the formula and examples below…

CAGR Calculator

Try calculating CAGR with different numbers. This is one of the best ways to learn.

When studying for the CFA exams, this was a core finance concept. It underpins much of the investing world. You can use it to help make better investing decisions…

CAGR Formula

To help learn how this works, here’s a short video explainer…

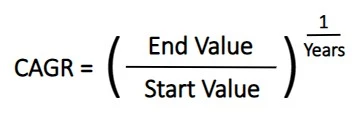

How do you calculate CAGR? Take the ending investment value divided by the starting value. Then from there, raise it to one over the number of years. This last step annualizes the return.

Here’s the CAGR formula…

Depending on where you’re calculating CAGR, don’t forget to use order of operations. Moving around parentheses can give different results. This is a common source of mistakes with finance formulas.

Now let’s plug in some numbers to see how this works. I’ll show you a few common examples and why this is a useful formula in finance…

CAGR Examples

Let’s say you invested $1,000 and it grew to $2,000 over 10 years. Your investment has gone up 2x or said another way, it’s up 100%. Not too shabby.

If I used the average most people are familiar with, I’d take 100% and divide by 10 years. This would give me a 10% return each year. However, this doesn’t account for compounding growth.

If $1,000 grew at 10% each year for 10 years, it’d grow to $2,594 in year 10…

| Start | $1,000 |

| 1 | $1,100 |

| 2 | $1,210 |

| 3 | $1,331 |

| … | … |

| 10 | $2,594 |

To get a deeper understanding of compounding growth, check out Arithmetic vs. Geometric Formulas.

Using this example to calculate CAGR, it gives us a lower annual return of 7.18%. And to get that value, I took 2,000 divided by 1,000. I then raised it to the power of one over 10 years. This is the constant annual rate it’d take 1,000 to grow into 2,000 (over 10 years).

CAGR Monthly Calculator

You can also use the CAGR calculator and formula to annualize monthly returns. For example, if you had an investment for six months, input 0.5 as the number of years.

For example, if your investment grew from $1,000 to $1,050 in six months, that’s a flat 5% return. And the CAGR formula annualizes it to 10.25%. Although, keep in mind that investment returns can jump around a lot and CAGR assumes a constant rate of change.

Why CAGR is Important for Investors

As shown above, CAGR is important for factoring in compounding growth. Your investments grow in a non-linear way. Each year, your investment’s value changes. As a result, a 10% gain will be a much smaller dollar value in the first year compared to 10% in year 10 and so on. It’s exponential growth.

On top of that, CAGR helps with comparing investment returns. The world of finance can be messy, along with your portfolio. You might hold one investment for two years and another for seven. Let’s say they each have a total gain of 25% and 70%, respectively.

Based on absolute return, the seven-year investment looks better. Who wouldn’t want a 70% gain instead of 25%? … but time is valuable and CAGR helps compare returns over time.

The two-year and seven-year investments have a CAGR of 11.80% and 7.88%, respectively. As a result, the two-year investment might be the better place to invest.

There are many other things to consider, but this is a good formula to keep in mind. It can help you improve your investing strategy.

If you have any questions about my CAGR calculator and examples, please reach out. And feel free to comment on any of my YouTube videos with questions. Or please let me know where you’re watching from. Because this helps motivate me to share more research and ideas.