The Molodovsky Effect might show up on your CFA exams. It’s one of thousands of terms and formulas. Let’s look at a definition and what’s useful to know. It fits into a bigger mental model for investors.

What is the Molodovsky Effect?

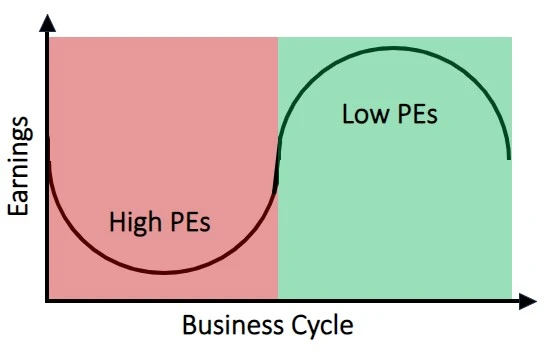

The Molodovsky Effect is when PE ratios are high during a downturn, and low when the industry is doing well. On the surface, this doesn’t make sense. Why do investors buy in at a higher valuation during a downturn?

To see how the Molodovsky Effect works, here’s a chart…

Molodovsky Effect and PE Ratios

Leading into and during a downturn, earnings are lower. Although, investors don’t push down stock prices as much. That’s why we tend to see higher PE ratios. For a quick revisit…

PE Ratio = Stock Price / Earnings per Share

If stock prices remain steady and earnings drop, the PE ratio is higher. And vice versa. Although, there are many factors affecting both stock prices and earnings. Do you know how Mosaic Theory applies to investors? Hint: it’s another CFA term to know.

Investors are forward-looking and the stock market is a leading indicator for the economy. For a cyclical industry in a downturn, investors expect earnings growth to return. That’s why they’re willing to buy in at a higher price, even though earnings are lower.

Value investors also tend to buy when PE ratios are lower. But with the Molodovsky Effect in mind, a low PE ratio doesn’t always mean it’s a good time to invest. On the individual company level, you can justify outlier PE ratios for many reasons.

When analyzing stocks to invest in, I rarely use PE ratios. Since earnings are at the bottom of the income statement, there are many adjustments leading to it, such as non-cash items. There are many different accounting rules, and they change over time as well.

Instead, comparing price to sales, operating margin, EBITDA, free cash flow and other metrics tends to be more reliable. Overall, PE ratios are more useful for analyzing industry and market trends…

Industry Trends and Mean Reversion

The idea behind the Molodovsky Effect fits into a bigger framework. If you’re investing in any given industry, it’s good to know its long-term trends. And where does it stand today? Do PE ratios and other valuation multiples make sense?

Here are four examples of cyclical industries…

- Airlines

- Banks

- Housing

- Energy

Other investors know the trends in these industries as well. You’re playing three-dimensional chess to find the best investments. And there are countless strategies at play…

Some moves may seem to go against common sense. For example, you might see an investor enter a position that doesn’t seem right. However, it could be a hedge for another holding. Pairs trading, unknown time horizons (reporting lag), countless derivative strategies, etc. Be wary of what you learn with the required 13F filings. Berkshire Hathaway is one of the few that is more useful (knowing that Warren Buffett’s favorite holding period is forever).

The Molodovsky Effect can help explain why stocks have lower PE ratios, even though earnings have been growing. And keep in mind that this trend doesn’t always hold. As mentioned, there are many factors that impact PE ratios.

Nonetheless, looking at long-term trends is useful. We tend to see mean reversion with many valuation multiples… on average, stock prices move around earnings. And both continue to climb higher in the long run. There’s also an inverse relationship with the S&P 500 PE ratio and future stock market returns.

CFA Exam Study Tips

It’s good to know the Molodovsky Effect for the CFA exams, but it’s better to understand the concept. The term is unnecessary jargon in the financial industry. And I could make a similar argument for the HHI Index, another CFA term. It’s just an added layer to show a non-linear relationship between market share and control.

For another industry example, why would you ever use the words posterior and anterior? It’s unnecessary medical jargon that means front and back. But I digress…

Overall, the CFA exams are worthwhile. They help you connect many dots in the business world. Feel free to check out that article to get tips on how I passed all three levels. I included a YouTube video as well. Please leave a comment to say hello or ask any questions 😊 and best of luck studying.