Robinhood just added $4,433 to my new Roth IRA account. This IRA bonus followed my transfer of just over $147,000 from an old Fidelity 401k. And it took me less than a day to research and start the transfer…

Is the Robinhood IRA transfer bonus worth it? Is Robinhood safe? How does it compare to others like Fidelity and Schwab?

Since I’ve done the research and moved some of my retirement savings, I’m well equipped to answer these questions. On top of that, I double majored in finance and accounting, as well as passed the CFA exams. The core study material for those exams was 6,000 pages.

To say the least, my insight here might be a little better than the average comments on Reddit. There are some threads on this topic, but they weren’t too helpful. Many even gave bad advice. So instead, I dug into the actual deal and legal docs from Robinhood.

Let’s first look at the IRA bonus details. Then from there, we’ll dive into the safety and if transferring makes sense for you.

Don’t have a Robinhood account? You can get a free stock by signing up with my referral link.

Robinhood IRA Bonus 3% Transfer

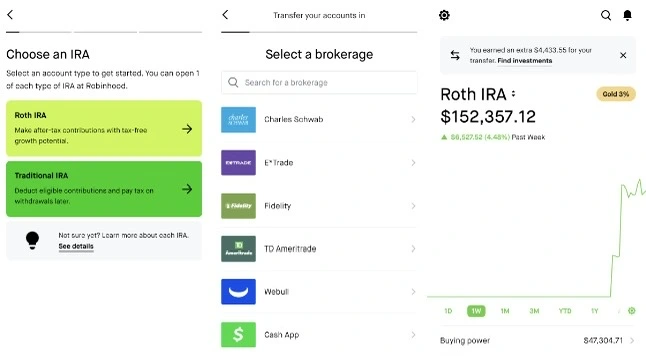

Robinhood is offering a 3% match for IRA transfers and 401k rollovers. This is for Gold members and the deal goes until April 30, 2024. For non-members, Robinhood still gives a 1% transfer bonus.

I wasn’t paying for Robinhood Gold before, but this deal made it worth it. It doesn’t cost much, and these next points factored into my decision. Robinhood can claw back the IRA bonus if you don’t meet two ongoing requirements…

1. Robinhood Gold for a Year

The first is staying a Robinhood Gold member for a year. This is a year going forward from the time of the transfer. If you were previously a Gold member, that doesn’t count towards the year.

I’ve started out with the free 30-day trial and the current cost is $5 per month. If that doesn’t change, I’ll end up paying $55 for the year. And that’s a drop in the bucket compared to my $4,433 IRA transfer bonus.

If you’re only able to transfer a few thousand dollars, the bonus might not make sense. Assuming $55 for a year of Robinhood Gold, you’d need to transfer $1,833 to breakeven.

However, there are other benefits of Robinhood Gold. For example, I’m earning a higher 5% interest rate on cash in my non-retirement Robinhood account. These other benefits might make it worth it at lower transfer amounts.

2. Don’t Transfer IRA for 5 Years

The other requirement is to keep the funds you transferred into the Robinhood IRA for 5 years. If you move the funds away before that, Robinhood can claw back your bonus. However, you can move subsequent gains. Just don’t draw down below the total transfer amount.

Five years is a long stretch, but it’s a retirement account. I’m hopefully not tapping into these funds for a few decades. Five years will fly by and maybe at that time, other brokerages will offer a transfer bonus. Rinse and repeat 🙂

If anything, this 5-year requirement pushed me to look more into the safety. How safe is it to invest with Robinhood? If Robinhood goes belly up or has other big structural changes, is my IRA safe? If that happens within 5 years, will I still keep the IRA transfer bonus?

Is Robinhood IRA FDIC Insured and Safe?

Similar to Fidelity, Schwab and other big retirement account providers, Robinhood IRAs have protections in place. And FDIC insurance generally doesn’t apply to these retirement accounts. For a better question, is it covered by SIPC insurance?

Yes, Robinhood IRAs have SIPC insurance. This backs up your investments up to $500,000 and it includes a $250,000 limit for cash.

If Robinhood goes under, your IRA is safe up to these limits. However, this doesn’t protect against bad investment decisions. If you throw everything into bad stocks, that’s on you. SIPC insurance just backs up the value of your investments, whatever they’re worth.

If anything, in the case of a default, the most annoying part might be the recovery process, similar to making other insurance claims. However, it could easily take more time. And with this in mind, how safe is Robinhood overall?

Is Robinhood Safe as a Company?

Robinhood is still the new kid on the block. It’s going up against giants in a regulatory intensive industry. Nonetheless, Robinhood is growing and teaching the old dogs some new tricks. The Robinhood IRA bonus is just one of them…

In 2013, Robinhood launched and had free trading for stocks and ETFs. This opened investing to smaller investors. And as Robinhood grew, the big brokerages had to follow suit. Schwab was the first domino to fall in 2019. And today, all big brokerages offer free trading.

Robinhood has focused on user experience and has expanded its product offerings over the years. It’s helped get many new people started with investing. However, it’s not without pushback…

Many investors point to Robinhood’s gamification as a negative. For most people, this leads to more short-term trading, and this usually leads to worse long-term performance. However, Robinhood doesn’t offer investing advice through its app. It’s up to you to decide how to invest with its cost-effective tools.

Robinhood has grown to 23.5 million funded customers. It continues to scale with strong incentives like its Robinhood IRA matching and transfer bonuses. It’s also starting to show profitability in a few recent quarters. On top of that, I’m not seeing any red flags in its balance sheet.

In other words, I think there’s a very low probability of Robinhood defaulting. If that does happen within 5 years, there’s a chance of clawing back the bonus. But either way, my IRA is safe thanks to the SIPC insurance, as well as other protections.

Also, given Robinhood’s current valuation, I won’t invest in the company. However, I’ll continue to use its products and I’m keeping it on my investing watchlist.

Robinhood vs. Fidelity vs. Schwab

I’ve used many brokerages over the years. Schwab is still my favorite, but Robinhood is gaining ground. I wouldn’t be surprised to see others start offering IRA matches and bonuses.

So far, I only have two pain points when using Robinhood. The first is how it shows portfolio contributions and gains over time. That’s more of a personal preference issue. However, the other might be more of a sticking point for you…

Robinhood hasn’t built out its customer service as well as others. I haven’t had much luck with its customer service messaging. Although, when I do get a call back, Robinhood’s reps have been knowledgeable and helpful.

For Fidelity, it’s had great customer service, but I haven’t been happy with its retirement account management. After many calls, I gave up looking into how it segmented traditional vs. Roth funds, etc. There’s unnecessary complexity with its workplace sponsored 401ks.

To get ready to transfer to Robinhood, I also had to jump through multiple hoops with Fidelity to move my old 401k. There was close to $0.61 left over in traditional funds after I requested to convert the entire balance to a Roth last year (just over $93,000). And even after requesting to transfer and close out the entire account, there’s still a $33 balance.

These small road bumps won’t likely apply to most. If you transfer funds for the 3% Robinhood IRA bonus, it shouldn’t take more than an hour of your time…

Robinhood IRA Bonus Transfer Stocks and Fees

With the Robinhood app, it was easy to set up an IRA and start the transfer process. It took me less than a few minutes and then Robinhood did all the work. It contacted Fidelity and managed the entire transfer process.

Robinhood also allows the transfer of stocks. So, I didn’t have to sell any positions. The 3% bonus applied to both the cash and value of the stocks.

On top of that, Robinhood will cover some transfer fees if the past brokerage charges an exit fee. Robinhood will cover up to $75 if you move at least $7,500. But with most big brokerages, like Fidelity, this is a moot point. Fidelity didn’t charge any transfer fees.

Is the Robinhood Gold IRA Bonus Worth It?

In my case, it was easy to justify the transfer for the Robinhood IRA bonus. It took less than a day of research for $4,433. And with my research in view, hopefully it takes you even less time to decide.

To give you a better idea if it’s worth it, here are a few examples. These show transfer amounts and the resulting bonuses…

- $2,000: Bonus: $60

- $10,000: Bonus: $300

- $50,000: Bonus: $1,500

- $150,000: Bonus: $4,500

- $500,000: Bonus: $15,000

If you have an old 401k account and IRAs, this might be a great time to consolidate. And although Robinhood is a new provider, it’s safe, similar to other big brokerages. On top of that, the bonus isn’t taxed (it’s treated as interest in the IRA).

Keep in mind that your small decisions today compound. Saving a few hundred dollars here and there adds up and compounds over time. For example, if my $4,433 bonus grows at 8% annually, it’ll climb above $65,000 by the time I hit retirement age.

To take it to the next level, here’s why I converted to a Roth account last year. I converted $93,269 and even with much smaller amounts, these moves can help you too. If you have any questions, please reach out. And once again, here’s how to sign up for a Robinhood account. You can get a free stock by using my referral link.