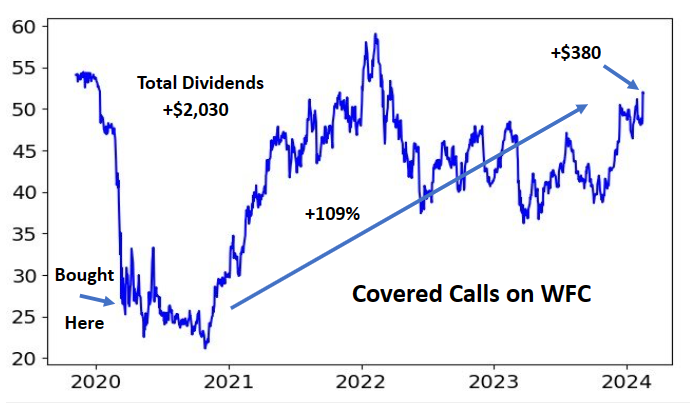

I bought 500 shares of Wells Fargo (WFC) in March of 2020 for $26.84 per share. It was a double contrarian play. The big bank wasn’t far out from a huge scandal. On top of that, the pandemic pushed down the entire market. But alas, the worst wasn’t over…

A few months later, Wells Fargo cut its dividend by 80%. And for most of 2020, my investment was underwater. But my thesis hadn’t changed and I held the position. Here’s how it’s played out…

Covered Calls on Wells Fargo

I just started selling covered calls on Wells Fargo. And it’s similar to why I’m selling covered calls on Meta. However, those calls were a partial hedge, and my WFC calls could close out my entire position. My WFC calls are also further out-of-the-money (OTM) and have a longer expiration. But why’s that the case?

Before we get to the logic of selling WFC covered calls, let’s look at a few reasons I invested in WFC in the first place…

Why I Bought Shares of Wells Fargo

I don’t bank at Wells Fargo. It’s not great for small consumers and investors. However, it still has a huge base and offers a wide range of financial services. It’s a cashflow machine that had some setbacks…

On top of the accounting scandal and pandemic, banking reputation hadn’t fully recovered from 2008 and 2009. Nonetheless, big banks are in much better shape since the Great Financial Crisis. That’s even factoring in the recent higher rates (R.I.P. SVB bank), along with the ugly holding pattern with commercial real estate loans.

Big banks like Wells Fargo have a better foundation. The Fed is also moving faster to prevent systemic failures. The fallout from Silicon Valley Bank could have been much worse. Although keep in mind… too big to fail doesn’t mean small investors can’t get the short end of the stick.

For a non-contrarian reason I jumped into WFC, I followed Warren Buffett’s lead. His holding company, Berkshire Hathaway, owned roughly 10% of the company. And no matter how much research I did, Warren Buffett’s stamp of approval carried more weight.

Warren Buffett Sells Wells Fargo

I saw Charlie Munger and Warren Buffett at an annual shareholder meeting 10 years ago. There’s a lot we can learn from these legendary investors. And they’re quick to point out that they’re prone to mistakes.

After the Wells Fargo phony account scandal, Berkshire started winding down its position. Its once top 10 holding, valued at over $30 billion, dropped off the books. However, this staggered exit wasn’t ideal timing. If anything, opportunity cost might have been a bigger motivator. Although, Berkshire’s ≈$150 billion cash pile has been a drag on the portfolio with lower rates.

Why I Sold WFC Covered Calls

My exit on WFC might be better than Buffett’s timing…

The company’s underlying strength and legal situation have improved. As a result, investors have pushed up the share price and it’s not far from all-time highs. However, its valuation has extended beyond its underlying growth, and it doesn’t look as enticing as when I invested.

This is one reason I sold covered calls. I’d be ok with realizing capital gains at a higher price. Let’s look at the details and then the logic behind this move…

WFC Covered Call Details

- Cost Basis: $26.84 (500 shares: $13,420)

- Contracts: 5 (500 shares)

- Strike Price: $70 (OTM 35%)

- Expiration: 12/20/2024 (309 days)

- Premium: $0.76 ($380)

These contracts limit my upside potential, but I’d be fine with locking in 35% in less than a year. That also doesn’t include a few quarterly dividends. So, I can tack on another 1.5% if not called away early (unlikely with American options).

I hold this in a taxable account, so I went a bit further OTM. That’s compared to my Meta covered calls in a Roth IRA. And it’s a good rule of thumb for investors to evaluate returns on an expected after-tax basis.

Uncle Sam will take his cut from my $380 premium and my take home will be close to $300. That works out to an instant 1.2% based on my current Wells Fargo position ($26,000). If called away, here’s my total gain…

Best Case Scenario for WFC Gains

Here’s my potential total gain (factoring in all dividend and call premiums)…

181% = (35,000 + 2,380 + 380) / 13,420 – 1

In this outcome, I would have held the position for 4.8 years. And that works out to a 24% average annual return. Check out my free CAGR calculator. That’s a great return that would easily beat average annual stock market returns.

If called away, I’d also have to pay over $3,000 in capital gains tax. However, at this exit price, the opportunity cost (even after tax) will likely be higher…

It’s been great to see Wells Fargo boosting its dividend again each year. Its current yield is 2.7% and based on recent trends, we should see another increase soon. However, even with another bump, the yield will likely come in well below 3% (based on the $70 strike price).

WFC Downside Protection

Overall, I’d be happy to lock in those gains. That’s factoring in a higher opportunity cost – from both an income standpoint, and otherwise. From one perspective, it’s the good ole bird in the hand approach.

However, there’s a decent probability that I won’t have my shares called away. The best case here would be the stock price closing just below the $70 strike price on expiration day. That would allow me to sell more covered calls at a higher strike price (for a better premium).

For a not so good outcome, Wells Fargo shares could drop to new lows. But at least I’d get to keep the dividends and covered call premiums. This provides a little downside protection.

Selling covered calls is similar to selling insurance. If priced right, sellers of insurance on average come out ahead. The buyers of insurance (and options) come out behind. Although, it makes sense to pay a premium to hedge certain risks.

If you have any questions, feel free to reach out on any of my YouTube videos. You can also find more ways to reach me on my contact page. Thanks for stopping by my blog 🙂