What’s the probability of a Leggett & Platt (LEG) dividend cut? I’d put it at a 70% chance within the next two years. But I still bought 300 shares today at a price of $19.93. And my dividend yield on cost comes in at 9.2%.

That’s a huge dividend yield, but it’s far from safe. So, why in the world would I buy LEG stock?

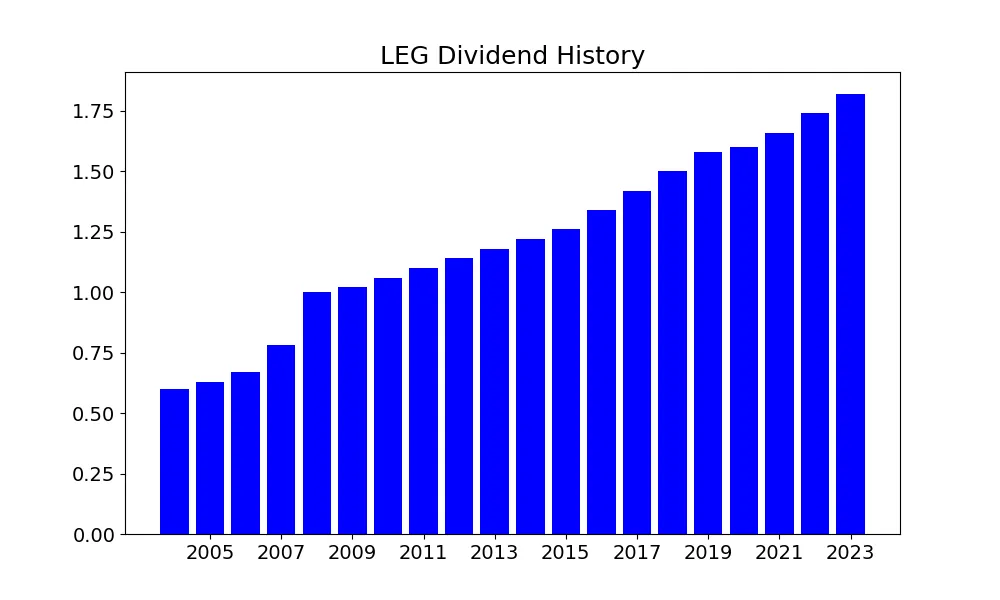

Leggett & Platt is a rare Dividend King. It’s paid investors a bigger dividend each year for over 50 years in a row. This is an impressive trend that’s spanned many market cycles. Through both the thick and thin, LEG has continued to reward investors.

To see recent trends, here are the annual dividends for the past 20 years…

Leggett & Platt Dividend Growth

This is a great trend to see, but there’s downward pressure on sales and profitability. On top of that, the balance sheet is far from its peak strength. This puts the dividend at higher risk of a cut.

LEG recently reported its full year 2023 results. Total sales came in at $4.7 billion, and that’s down 8% from the previous year.

Management is also expecting sales to drop further. For 2024, they’re projecting total sales to come in close to $4.5 billion. And that’d be down another 4% year-over-year. All the while, inflation continues to eat away at our purchasing power.

On a positive note, cash from operations increased last year. It came in at $497 million, up close to 13% year-over-year. On top of that, the company reported $365 million in cash on hand, along with access to $332 million in a revolving credit facility.

This compares to $2 billion in total debt, with $308 million for current debt maturities. Overall, LEG’s leverage ratios have climbed but aren’t far from industry averages. Nonetheless, this leverage, along with cash flow pressures and higher payout ratios have led investors to beat down LEG’s stock price.

Leggett & Platt Dividend Cut

No management team wants to end a long track record of dividend growth. I wouldn’t want that on my resume. Steady and sustainable dividend growth is a sign of great management over many years. Stable dividend growth is also great when valuing a stock with a Gordon Growth Model Calculator.

LEG’s dividend track record has pulled in many investors. But nothing lasts forever… for a recent example, VF Corp (VFC) had a similar history of paying bigger dividends for 50 years. And if not familiar, this is a consumer clothing company that owns Vans and the North Face brands, along with many others. However, some missteps cut this Dividend King down from its throne. That begs the question…

Will an LEG dividend cut follow VFC’s lead? Also, 3M (MMM) is another Dividend King with a high risk of cutting its dividend (due to legal risks).

With LEG’s recent earnings call, they’ve guided to pay a larger annual dividend. They’re bumping the dividend a few cents to keep Dividend King status. However, always take management’s guidance with a grain of salt…

We are focused on maintaining our investment grade credit rating and managing debt leverage while balancing continued investment in our business for future growth and our dividend track record.

As mentioned, I think there’s roughly a 70% chance of a dividend cut in the next two years. And for this year, it’s a lower probability. Leggett & Platt has some financial wiggle room and solid management… but there are larger market trends at play. The turning labor market and consumer stress could put more pressure on the company.

Why I Bought LEG Stock

This is far from a sure bet, but I like the risk-to-reward based on the current price. Investors have beaten down this Dividend King and I think investors have already baked in the major risks.

Even if the company cuts its dividend in half, my yield on cost would be 4.6%. If that happens, that’d free up roughly $122 million in 2024 for the company to shape up its balance sheet.

Of course, it could always get worse, but that’s part of the game to investing. For a better perspective, this is a small position in my portfolio. And over the course of 10 similar investments, I should come out ahead.

Here’s one of my old (but timeless) videos on diversification. Warren Buffett gives advice that many people misunderstand. Feel free to check it out and if you have any questions about the video or my investing research, please leave a comment. I always appreciate a simple “hello” as well 🙂 or where are you reading or watching from?